Media Leaders on AI: Insights from Disney, ESPN, Forrester Research

The explosion of visual content is almost unbelievable, and creative, marketing, and ad teams are struggling to keep up. Content workflows are slowing down, and teams can't find the right assets quickly enough.

The crucial question is: How can you still win with the influx of content and keep pace with demand?

Find out on Jan 14, 2026, at 10am PT/1pm ET as industry leaders—including Phyllis Davidson, VP Principal Analyst at Forrester Research, and former media executive Oke Okaro as they draw on their deep media research and experience from ESPN, Disney, Reuters, and beyond.

In the webinar, "The Future of Content Workflows: How AI is Powering the Next Wave," you’ll learn:

The forces reshaping content operations

Where current systems are falling short

How leading organizations are using multimodal AI to extend their platforms

What deeper image and video understanding unlocks for monetization

Get clear insight and actionable perspective from the leaders who built and transformed top media and entertainment organizations.

1. US Markets Close 2025 on Record Highs, AI Sector Shifts Focus (Cited in 9 tech media)

US markets achieved new record highs in a holiday-shortened session, capping a year of remarkable gains. The S&P 500, Dow, and Nasdaq all surged. Strong economic data, including robust GDP and falling jobless claims, underpinned this momentum. However, the Federal Reserve cut rates, citing concerns over employment growth and AI's impact on labor. The AI investment landscape evolved, favoring infrastructure plays over broad tech. Gold and silver prices reached unprecedented levels. Corporate M&A and IPO activity remained robust. European markets saw mixed results, while US-EU geopolitical tensions flared over digital content. Investors anticipate moderate gains for 2026, with focus on diversified opportunities.

2. Nvidia Secures AI Inference Power in $20 Billion Groq Licensing Deal (Cited in 8 tech media)

Nvidia commits $20 billion for Groq's critical AI inference chip assets and top talent. This "non-exclusive licensing agreement" significantly enhances Nvidia's real-time AI processing capabilities, deepening its AI factory architecture. The unconventional structure strategically sidesteps antitrust scrutiny, a growing concern in the booming AI sector. Groq's founder and key leaders transition to Nvidia, while Groq's independent cloud operations continue. This aggressive investment solidifies Nvidia's unparalleled dominance across the entire artificial intelligence ecosystem. It ensures a stronger position against competitors in the highly specialized chip market. Nvidia's vast cash reserves fuel this expansion, targeting future growth. The deal reshapes the AI chip landscape.

3. Coupang Pays Billions After Massive Data Breach (Cited in 5 tech media)

South Korean e-commerce titan Coupang faces a significant data breach impacting 34 million accounts. The company commits $1.17 billion in compensation, issuing vouchers to both current and former customers. Initial communication missteps prompted leadership changes and public apologies. Eligibility verification for these vouchers starts January 15. The incident highlights critical challenges in online retail cybersecurity, consumer trust, and the need for transparent corporate response in data privacy matters.

4. Samsung TVs Transform Home Viewing with Google Photos Integration (Cited in 4 tech media)

Samsung televisions will integrate Google Photos starting in 2026. Users gain seamless access to their cherished memories directly on the big screen. This groundbreaking partnership delivers a cinematic photo experience. Key features roll out throughout the year. Initial launch, "Memories," arrives exclusively in early 2026. It curates photos by people, places, and significant moments. Later in 2026, advanced AI-powered tools will debut. These include "Create with AI" for playful photo transformations and "Personalized Results" for context-aware slideshows. The integration deepens the smart TV's role, blending entertainment with personal digital archives. Users can relive family trips, hobbies, and daily moments with unprecedented immersion. This update significantly elevates the home viewing experience, making memories central to daily life. It's a major step for smart home connectivity, enhancing how families interact with their digital past.

Truecaller significantly ramped up its share buyback efforts in December 2025. The company repurchased 2.697 million B shares in weeks 50 and 51 alone. This aggressive strategy reduces outstanding capital. It reinforces investor confidence. The current buyback program, authorized until Truecaller's May 2026 AGM, now totals over 6.4 million shares. These actions underscore a commitment to shareholder value. Trading activity remains robust on Nasdaq Stockholm. Truecaller, a leading global platform for secure communication, uses these financial moves to optimize its capital structure and demonstrate its long-term vision.

6. Asset Management Giant Janus Henderson Acquired for $7.4 Billion in Major Industry Shakeup (Cited in 4 tech media)

Janus Henderson, a global asset manager, is being acquired for $7.4 billion by Trian Fund Management and General Catalyst. The all-cash deal, valued at $49 per share, represents an 18% premium to its unaffected price. This strategic move takes Janus Henderson private by mid-2026. The new ownership group plans significant, focused investment in advanced technology, particularly AI, and enhanced client services. Trian has been a long-term, influential shareholder with board representation, providing deep insight. This transaction marks a critical consolidation within the global asset management industry, signaling a future-forward approach to financial services with emphasis on digital transformation and operational efficiency. It sets a new benchmark for strategic private equity involvement in established firms, promising accelerated growth and innovation.

7. Houston's Innovation Soars: Science, Space, Startups Define 2025 (Cited in 4 tech media)

Houston's innovation landscape thrived in 2025. Over fifty local scientists earned global recognition as highly cited researchers, showcasing deep expertise across fields. The region's space tech sector saw unparalleled growth. Companies secured billions in NASA contracts. Lunar missions advanced. Commercial space efforts expanded. Texas experienced a significant startup boom, with Houston leading this economic surge. Women entrepreneurs drove much of this new business creation. A groundbreaking spaceflight made history, demonstrating enhanced accessibility for disabled travelers. Vital funding also bolstered opioid addiction research. Houston affirmed its status as a premier hub for scientific achievement, technological advancement, and robust economic development throughout the year.

8. Samsung's HARMAN Acquires ZF ADAS Unit: Reshaping Automotive Future (Cited in 4 tech media)

HARMAN, a Samsung company, acquires ZF Group's ADAS business for €1.5 billion. This move boosts HARMAN's automotive technology strength significantly. It integrates advanced driver assistance systems, smart cameras, and vital compute solutions. The deal propels HARMAN into next-generation vehicle architectures. It also solidifies its role in software-defined mobility. Digital cockpit offerings gain new depth. Samsung's commitment to future car innovation deepens. In-vehicle experiences will become smarter, safer, more connected. This positions HARMAN at the forefront of automotive transformation. ZF reduces debt, hones its core business focus. About 3,750 ZF employees will join HARMAN. The transaction eyes a late 2026 completion, pending approvals.

9. Global Markets Soar: Tech Leads Rally, Gold Hits Records Amid Rate Hopes, Geopolitical Tensions (Cited in 4 tech media)

Global markets surged. Tech stocks propelled Wall Street gains. Asian equities followed suit. Gold and silver achieved new record highs. Hopes for Federal Reserve interest rate cuts fueled the precious metals rally. The Bank of Japan's rate hike weakened the yen, sparking speculation of future currency market intervention. Oil prices climbed amidst mounting concerns over Venezuelan supply disruptions and broader geopolitical instability. Investors navigate dynamic monetary policies and ongoing global events.

10. Houston's Innovation Soars: Science, Space, Startups Define 2025 (Cited in 4 tech media)

Houston's innovation landscape thrived in 2025. Over fifty local scientists earned global recognition as highly cited researchers, showcasing deep expertise across fields. The region's space tech sector saw unparalleled growth. Companies secured billions in NASA contracts. Lunar missions advanced. Commercial space efforts expanded. Texas experienced a significant startup boom, with Houston leading this economic surge. Women entrepreneurs drove much of this new business creation. A groundbreaking spaceflight made history, demonstrating enhanced accessibility for disabled travelers. Vital funding also bolstered opioid addiction research. Houston affirmed its status as a premier hub for scientific achievement, technological advancement, and robust economic development throughout the year.

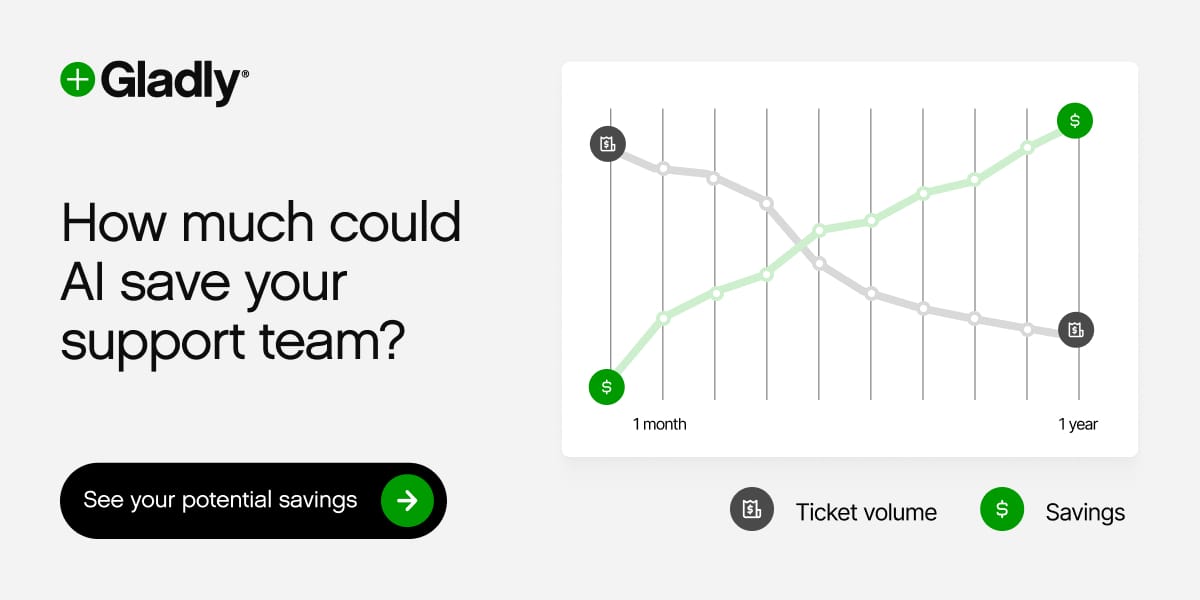

Can you scale without chaos?

It's peak season, so volume's about to spike. Most teams either hire temps (expensive) or burn out their people (worse). See what smarter teams do: let AI handle predictable volume so your humans stay great.

Your fast-track to Asia’s hottest trends. asiabits delivers sharp insights on tech, business & culture. What the world talks about tomorrow, you read today.

Investing Newsletter for people (45-65) who are looking for a faster retirement. The goal is to make a better return investing in blue chip companies.

Clicking our affiliate links may earn us a small commission, which helps us keep this newsletter running and improve it for you.